nh meals tax calculator

The tax applies to any room rentals for less than 185 consecutive days and to function rooms in any facility that also offers sleeping accommodations. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

The tax is 625 of the sales price of the meal.

. A calculator to quickly and easily determine the tip sales tax and other details for a bill. There are however several specific taxes levied on particular services or products. 0 5 tax on interest and dividends Median household income.

Additional details on opening forms can be found here. Fillable PDF Document Number. New Hampshire income tax rate.

Tax Returns Payments to be Filed. Some schools and students. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax.

100 on sales of alcoholic. The tax is 625 of. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

A 9 tax is also assessed on motor vehicle rentals. New Hampshire is one of the few states with no statewide sales tax. New Hampshire Paycheck Quick Facts.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. Last updated November 27 2020. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor What is the rooms and meals tax in VT.

File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT. A New Hampshire FoodBeverage Tax can only be obtained through an authorized government agency. 625 of the sales price of the meal.

This new system will replace our current e-file system for Real Estate Transfer Tax counties DP-4 payments as of January 1 2022. Subscribe to Meals Rentals Operators Notifications to receive NH DRA announcements guidance and other helpful information. Using deductions is an excellent way to reduce your New Hampshire income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and New Hampshire tax returns.

Short Term Rentals Are Subject To Nh Rooms Meals. 2022 New Hampshire state sales tax. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Updated Home On Lake Sunapee With Breath-taking With Breath-taking Views. The meals tax rate is 625. The Current Use Board is proposing to readopt with Amendment Cub 30503 Cub 30504 -Assessment Ranges for Forest Land Categories With and Without.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Be sure to visit our website at revenuenhgovGTC to create your account access today. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

90 on sales of prepared and restaurant meals. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Exact tax amount may vary for different items.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The meals tax rate is 625. The meals tax rate is 625.

Designed for mobile and desktop clients. We pay 9 percent which goes into state coffers well most of it. As such New Hampshire Interest Dividends and Business Tax Business Profits Tax and Business Enterprise Tax returns that are due on Friday April 15 2022 will be due on Monday April 18 2022.

Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served the holder of the license is presumed to be the meals tax vendor whether the meals are served by the license holder or a concessionaire. A 9 tax is also assessed on motor vehicle rentals. This Open Concept House Has 2 Bedrooms Washerdryer And An Attached Garage With Parking For 1 Vehicle And 2 Outside Spaces.

There is also a 85 tax on car rentals. New Hampshire Tax Deductions Income tax deductions are expenses that can be deducted from your gross pre-tax income. Tax Rates for Meals Lodging and Alcohol.

Meals paid for with food stampscoupons. Please visit GRANITE TAX CONNECT to create or access your existing account. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. If you have any questions about tax-exempt sales please call the Departments Division of Taxpayer Services for clarification at 603 230-5030. Our small business tax calculator has a separate line item for meals and entertainment because the irs only allows companies to deduct 50 of those expenses.

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. What is it. Before August 1 2009 the tax rate was 5 Generally food products people commonly think of as groceries are exempt from the sales tax except.

If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001. Use this app to split bills when dining with friends or to verify costs of an individual purchase. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9.

The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. What is the Meals and Rooms Rentals Tax. Census Bureau Number of cities that have local income taxes.

You only have to file a new hampshire income tax return if you have earned over 2400 annually 4800 for joint filers in taxable dividend and interest income. 90 on sales of lodging and meeting rooms in hotels.

6 Steps To Sales Tax Compliance Just In Time For The Holidays Taxjar

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax The Complete Guide To Sales Tax In The United States Taxjar

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Income Tax Calculator Smartasset

New Hampshire Sales Tax Rate 2022

New Hampshire Income Tax Nh State Tax Calculator Community Tax

States With Highest And Lowest Sales Tax Rates

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Massachusetts Sales Tax Calculator Reverse Sales Dremployee

New Hampshire Sales Tax Rate 2022

New Hampshire Income Tax Calculator Smartasset

New Hampshire Income Tax Nh State Tax Calculator Community Tax

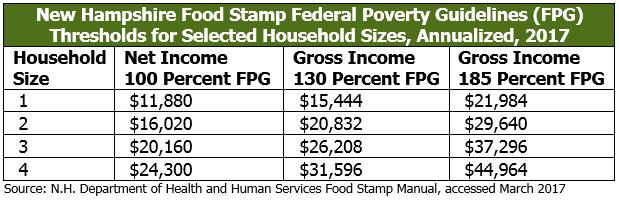

The New Hampshire Food Stamp Program New Hampshire Fiscal Policy Institute

States Without Sales Tax Article

New Hampshire Meals And Rooms Tax Rate Cut Begins

New Hampshire Income Tax Calculator Smartasset

2021 Taxes And New Tax Laws H R Block

New Hampshire Income Tax Nh State Tax Calculator Community Tax